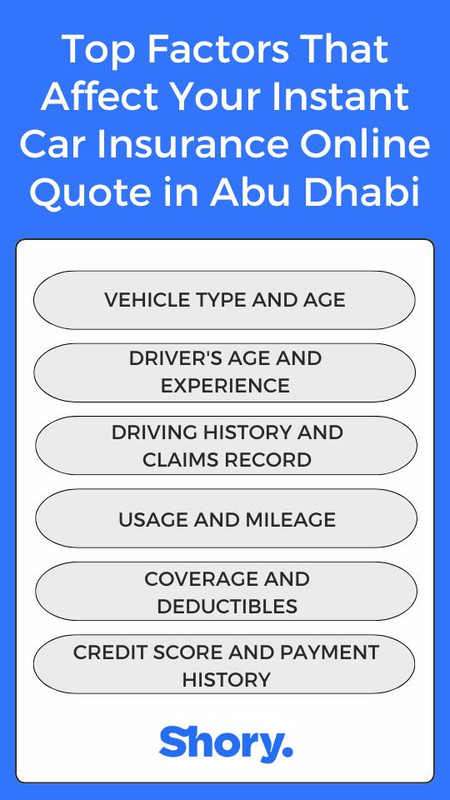

Obtaining car insurance is a crucial step for any driver, and in Abu Dhabi, the process has been simplified with the availability of instant car insurance quotes online. However, various factors can influence the cost and coverage of your car insurance in Abu Dhabi. Understanding these factors can help you get the best deal and ensure you are adequately covered. In this blog, we will explore the key elements that affect your instant car insurance online quote in Abu Dhabi, providing you with the knowledge needed to make informed decisions.

Vehicle Type and Age

One of the primary factors influencing your car insurance in Abu Dhabi is the type and age of your vehicle. Newer cars typically have higher insurance premiums because they are more expensive to repair or replace. Conversely, older cars may have lower premiums but might lack certain safety features that newer models possess. Additionally, luxury cars or high-performance vehicles often attract higher insurance costs due to their higher repair costs and increased risk of theft. When seeking an instant car insurance quote, it's essential to provide accurate details about your vehicle to get an accurate estimate.

One of the primary factors influencing your car insurance in Abu Dhabi is the type and age of your vehicle. Newer cars typically have higher insurance premiums because they are more expensive to repair or replace. Conversely, older cars may have lower premiums but might lack certain safety features that newer models possess. Additionally, luxury cars or high-performance vehicles often attract higher insurance costs due to their higher repair costs and increased risk of theft. When seeking an instant car insurance quote, it's essential to provide accurate details about your vehicle to get an accurate estimate.

Driver's Age and Experience

The driver's age and experience significantly impact car insurance in Abu Dhabi. Younger drivers, especially those under 25, usually face higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents. Similarly, new drivers or those with a short driving history may also encounter higher insurance costs. On the other hand, experienced drivers with a clean driving record can benefit from lower premiums. When applying for an instant car insurance quote online, ensure you provide accurate information about your driving history to receive a precise quote.

Driving History and Claims Record

Your driving history and claims record play a crucial role in determining your car insurance in Abu Dhabi. Insurers assess your risk based on past behaviors, so drivers with a history of accidents or traffic violations will likely face higher premiums. Conversely, a clean driving record with no claims can result in lower insurance costs. When requesting an instant car insurance quote, be prepared to disclose any past incidents or claims, as this information directly influences your quote.

Your driving history and claims record play a crucial role in determining your car insurance in Abu Dhabi. Insurers assess your risk based on past behaviors, so drivers with a history of accidents or traffic violations will likely face higher premiums. Conversely, a clean driving record with no claims can result in lower insurance costs. When requesting an instant car insurance quote, be prepared to disclose any past incidents or claims, as this information directly influences your quote.

Usage and Mileage

How you use your vehicle and the distance you drive annually are significant factors affecting your car insurance in Abu Dhabi. Vehicles used for daily commuting or business purposes typically incur higher premiums than those used for leisure or occasional driving. Additionally, higher mileage increases the risk of accidents, leading to higher insurance costs. When obtaining an instant car insurance quote online, accurately reporting your vehicle's usage and expected annual mileage is crucial for an accurate quote.

Coverage and Deductibles

The level of coverage and deductibles you choose also affect your instant car insurance quote in Abu Dhabi. Comprehensive coverage, which includes protection against theft, vandalism, and natural disasters, will have higher premiums than basic third-party liability coverage. Similarly, opting for lower deductibles results in higher premiums, while higher deductibles can reduce your premium but require you to pay more out-of-pocket in the event of a claim. When seeking an instant car insurance quote, carefully consider your coverage needs and budget to select the appropriate level of coverage and deductibles.

The level of coverage and deductibles you choose also affect your instant car insurance quote in Abu Dhabi. Comprehensive coverage, which includes protection against theft, vandalism, and natural disasters, will have higher premiums than basic third-party liability coverage. Similarly, opting for lower deductibles results in higher premiums, while higher deductibles can reduce your premium but require you to pay more out-of-pocket in the event of a claim. When seeking an instant car insurance quote, carefully consider your coverage needs and budget to select the appropriate level of coverage and deductibles.

Credit Score and Payment History

In some regions, insurers consider your credit score and payment history when determining your car insurance in Abu Dhabi. A good credit score often correlates with responsible financial behavior, which can translate to lower insurance premiums. Conversely, a poor credit score or history of late payments can result in higher costs. Although this factor may not apply to all insurance providers in Abu Dhabi, it's essential to maintain good financial habits to potentially benefit from lower premiums. When requesting an instant car insurance quote online, be aware that your credit score might influence the final estimate.

Conclusion

Understanding the top factors that affect your instant car insurance online quote in Abu Dhabi is essential for making informed decisions and securing the best coverage at competitive rates. By considering the vehicle type and age, driver's age and experience, driving history, usage and mileage, coverage options, and possibly even your credit score, you can better navigate the car insurance landscape in Abu Dhabi. Ensure you provide accurate information when seeking an instant car insurance quote to receive the most precise and beneficial estimate. With this knowledge, you can confidently select the car insurance that best suits your needs and budget, ensuring peace of mind on the roads of Abu Dhabi.

levefe levefe 11 months ago