https://onetouchexim.com/ OneTouch Exim is a leading and reliable manufacturer and exporter of stainless steel products, including steel tubs, tubing & welding pipe, among others. Our equipment helps enhance the interior beauty of your space and fulfill customer requests and requirements, ensuring that they contribute to making your project of high quality. One Touch Exim ensures that we remain the top choice of our customers in the stainless steel industry. However, we are providing all stainless steel equipment for your project requirements. Our product range caters to a diverse range of needs, and we manufacture and deliver high-quality products. When you need to make a purchase, we promise to provide the product to your doorstep on time. Click here- https://onetouchexim.com/

Hospitals have been facing a big challenge: patients disappearing midway through their care cycle. Hospital CRM Software is helping solve that by delivering structured follow-ups, reminders, and smoother communication. It captures every interaction point, making sure no patient falls through the cracks. Hospitals using CRM solutions report better retention, faster response rates, and improved satisfaction scores. If drop-offs are a concern, CRM could be the strongest lever available right now.

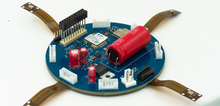

RAK3172 is a LoRaWAN module based on the STM32L4 microcontroller, optimized for low-power IoT applications.

It is widely used in custom LoRaWAN boards due to its compact footprint,

low current consumption, and support for both AT command and RUI3 development modes.

This guide highlights the key design considerations for creating a custom LoRaWAN end-device circuit board for low-power IoT applications,

beginning with a basic schematic diagram of the RAK3172 LoRaWAN module and followed by an explanation of each section.

We sale good quality Heavy water caluanie oxidize made in US. Buy Caluanie Oxidize online usa Where to buy Caluanie Oxide online usa Wholesale Caluanie Oxide online. Caluanie Muelear Oxidize For sale. Chemicals are widely used across various manufacturing industries for a wide range of purposes. Caluaine Oxidize is one of the most demanded products in the metal or chemical processing sector. Some of its core applications include:

WhatsApp(+44 7397 620325)WhatsApp(+44 7397 620325)

{ Request video call, See your product before buying , We do accept meet up for exchange} WhatsApp(+44 7397 620325)

You place an order: 2L to 1000 liters. WhatsApp(+44 7397 620325)

Type: caluanie muelear oxidize

-Density: 1600 g / l and 1.944 g

-Weight: 1650 g / l 1900 g

-Manufacturer: USA,

-Expiry date: no expiration date

-Characteristics: Embrittlement of metals does not interact with other chemical components

-Do not burn your hands

-Designed for reusable use

-Shipping: Worldwide Delivery

CONTACT IF INETERESTED

WhatsApp(+44 7397 620325)

Telegram @Frink001

Email(ligakvas@yahoo.com

Pure Red And Silver Mercury at affordable prices. Specification On Red Mercury Are As Follows: Pure Red liquid Mercury of 99.9999% purity. We supply red mercury which basic are as follows: Molecular formula: Sb2O7Hg2. Density: 20/20. Purity: 99.9999%. Color: Cherry red. Form Silver and Red Liquid Mercury Metal For Sale in Saudi Arabia, Dubai Kuwait, Qatar, Sudan United States, United Kingdom, South Africa, Johannesburg, Zimbabwe, Zambia, Benin, Angola, Product Detail We offer best quality

WhatsApp(+44 7397620325)

Telegram @Frink001

Email(ligakvas@yahoo.com

В мире онлайн-казино, где конкуренция растет с каждым днем, Лаки бир выделяется среди других благодаря своим уникальным предложениям и высокому качеству обслуживания. В 2024 году все больше игроков обращают внимание на это казино, готовясь воспользоваться его заманчивыми возможностями. Но что именно привлекает внимание экономных игроков и какие преимущества предлагает Лаки бир?

Быстрая и безопасная регистрация

Для того чтобы начать играть, вам понадобится пройти регистрацию. Вот простой пошаговый процесс:

- Посетите https://voditporusski.ru для регистрации.

- Нажмите на кнопку "Регистрация".

- Заполните необходимые поля: имя, адрес электронной почты и пароль.

- Подтвердите свою учетную запись через электронное письмо.

- Войдите в свою учетную запись.

- Пополните баланс удобным для вас способом.

Данная процедура занимает всего несколько минут и позволяет быстро окунуться в мир азартных игр.

Уникальные бонусы и акции

Лаки бир предлагает щедрые бонусы, что делает его особенно привлекательным для новых и постоянных игроков.

- Приветственный бонус для новичков: Получите дополнительный процент на первое пополнение.

- Кэшбек: Возврат части проигранной суммы.

- Регулярные акции: Лаки бир активно проводит розыгрыши и турниры, где можно выиграть ценные призы.

Эти предложения значительно увеличивают шансы на успех в играх, что особенно важно для экономных игроков, ищущих выгодные условия.

Скорость транзакций

Еще одним важным аспектом является скорость транзакций на Лаки бир. В эпоху цифровизации, игроки ожидают удобства и быстроты:

- Мгновенные депозиты: Пополнение счета происходит в считанные секунды.

- Вывод средств: Обработка запросов на вывод денег осуществляется в минимально короткие сроки. Игроки часто отмечают, что средства приходят в течение нескольких часов.

Эти преимущества делают Лаки бир оптимальным выбором для экономных игроков, ценящих свое время.

Пользовательский опыт и отзывы игроков

Опыт, с которым сталкиваются игроки на платформе, играет ключевую роль в формировании их мнения. Лаки бир имеет положительные отзывы о пользовательском интерфейсе и уровне обслуживания.

- Простой навигационный интерфейс: Удобное расположение разделов и игр.

- Круглосуточная поддержка: Команда профессионалов готова ответить на вопросы и решить возникающие проблемы в любое время.

Заключение

В 2024 году конкуренция в мире онлайн-казино будет нарастать, и Лаки бир, безусловно, укрепит свои позиции благодаря уникальным бонусам, быстрой регистрации и високой скорости транзакций. Если вам важен качественный сервис и выгодные предложения, это казино станет отличным выбором. Не упустите возможность стать частью этого увлекательного мира азартных игр! Убедитесь сами, зарегистрировавшись на https://voditporusski.ru.

Посетите https://veshinameste.ru для регистрации. Виртуальные казино становятся всё более популярными, и вместе с этим возрастает и необходимость обеспечения безопасности игроков. Вход в казино Олимп требует особого внимания к вопросам защиты личных данных и безопасности аккаунта.

Защита персональных данных

Современные онлайн-казино, такие как Олимп, предлагают своим пользователям надежные механизмы защиты. При входе в систему важно учитывать следующие аспекты:

- Использование сложного пароля.

- Двухфакторная аутентификация.

- Регулярные обновления программного обеспечения.

Эти меры существенно снижают вероятность несанкционированного доступа к вашему аккаунту.

Качество поддержки пользователей

Безопасность в онлайн-казино не ограничивается только техническими аспектами. Высокое качество поддержки пользователей также является важным фактором.

На что стоит обратить внимание при выборе казино: - Наличие круглосуточной поддержки. - Разнообразие каналов связи (чат, телефон, электронная почта). - Быстрая реакция на запросы игроков.

Казино Олимп выделяется благодаря оперативности своей службы поддержки и готовности помочь в любых ситуациях.

Безопасные способы пополнения счета

При входе в казино необходимо учитывать безопасность финансовых операций. Выбор проверенных платежных методов поможет избежать возможных рисков. Вот рекомендованные способы:

- Банковские карты.

- Электронные кошельки.

- Криптовалютные переводы.

Обеспечьте безопасность своих финансов, используя только известные и проверенные методы.

Заключение

С учетом глобализации рынка онлайн-гемблинга безопасность становится ключевым аспектом при выборе казино. Тщательная защита пользователя и высокий уровень поддержки — это то, что предлагает казино Олимп. Не забывайте о важности мерами безопасности при входе и следуйте всем рекомендациям для комфортной игры.

Для получения подробной информации посетите https://veshinameste.ru.

Турниры и соревнования в мире азартных игр становятся всё более привлекательными для игроков, стремящихся не только получить удовольствие от игры, но и заработать. Олимп, одно из известных казино, предлагает разнообразные аппаратные и живые турниры, которые могут привлекать как новичков, так и мастеров. Если вы задумываетесь о том, как выбрать интересный турнир или соревнование, эта статья поможет вам разобраться в основных аспектах.

Что такое турниры в онлайн-казино?

Турниры в онлайн-казино представляют собой соревнования, в которых игроки сражаются друг с другом, используя свои навыки и удачу. Каждый игрок делает ставки на определённых играх, и по итогам определяется победитель на основе набранных очков или выигрыша. У казино, таких как Олимп, турниры отличаются разнообразием - это могут быть как игровые автоматы, так и настольные игры, такие как покер и блэкджек.

Преимущества участия в турнирах

Участие в турнирах предоставляет игрокам массу преимуществ. Во-первых, это возможность выиграть внушительные призы, которые часто превышают обычные выигрыши. Во-вторых, турниры способствуют социализации игроков: вы можете соревноваться с другими, общаться и обмениваться опытом. Наконец, турниры в Олимп часто бывают освещены специальными акциями и бонусами, что делает участие ещё более выгодным.

Безопасность участия в турнирах

Основным аспектом, который волнует многих игроков, является безопасность. Олимп уделяет большое внимание защите своих клиентов, поэтому участие в турнирах здесь гарантирует, что ваши данные и средства находятся в безопасности. Казино использует новейшие технологии шифрования и соблюдает все необходимые стандарты безопасности.

При выборе турниров в Олимп стоит обратить внимание на их расписание, условия участия и призы. Не упустите возможность насладиться уникальной атмосферой азартных игр и испытать удачу на турнирах. Для более подробной информации о текущих турнирах и акциях посетите https://vakansiavsem.ru.

Не забывайте следить за обновлениями и не упустите шанс стать не только участником, но и победителем!

Отличный выбор казино может значительно улучшить ваш игровой опыт. Если вы ищете платформу для азартных игр, в которой уделяется внимание живым играм, стоит обратить внимание на Ф1. Этот обзор поможет вам разобраться, что предлагает данное казино и как выбрать оптимальный вариант для своих нужд.

Преимущества живых игр в казино

Игра в живом формате обладает несколькими неоспоримыми преимуществами:

- Реалистичность: Живые игры позволяют ощутить атмосферу настоящего казино.

- Социальный аспект: Возможность взаимодействовать с другими игроками и дилерами.

- Разнообразие игр: Блэкджек, рулетка и покер доступны в режиме реального времени.

- Удобство: Играть можно прямо с вашего устройства, без необходимости покидать дом.

- Честность: Прямые трансляции обеспечивают прозрачность происходящего.

Недостатки игроков в живые казино

Тем не менее, присутствуют и определенные недостатки, о которых стоит помнить:

- Требование хорошего интернет-соединения: Плохая связь может испортить игровой процесс.

- Меньшее разнообразие игр: В сравнении с обычными слотами, выбор может быть ограничен.

- Время ожидания: Игроки могут ожидать своей очереди на популярных столах.

- Высокие ставки: Некоторые живые игры имеют более высокие минимальные ставки.

Учитывайте пользовательский опыт

Важно учитывать не только игровые предложения, но и общее качество платформы. На что обратить внимание:

- Совместимость с мобильными устройствами: Удобство игры на смартфонах и планшетах.

- Интерфейс: Пользовательский опыт должен быть интуитивно понятным.

- Поддержка клиентов: Наличие качественной службы поддержки и доступных каналов обращения.

- Безопасность платежей: Поддержка надежных методов депозита и вывода средств.

- Бонусы и акции: Выгодные предложения могут существенно повысить вашу прибыль.

Казино Ф1 предлагает своим пользователям ряд привлекательных условий, поэтому стоит обратить на него внимание. Для тех, кто ищет опыт игры с живыми дилерами, это может стать отличным вариантом.

Посетите https://uborka-kvartir-v-moskve.ru для регистрации. Узнайте больше о возможностях, которые предлагает Ф1. Воспользуйтесь всеми преимуществами живых игр и получайте удовольствие от азартного времяпрепровождения.

Современные технологии открыли новые горизонты для любителей азартных игр, и онлайн-казино, такие как Орка 88, активно адаптируются к этим изменениям. Мобильный опыт стал важнейшим аспектом для игроков, желающих наслаждаться любимыми играми в любое время и в любом месте. Данная статья подробно рассмотрит функционал и преимущества мобильной версии казино, а также доступные бонусы при депозитах.

Мобильный опыт: ключевые особенности

Мобильные версии казино значительно отличаются от стационарных, предлагая игрокам удобство и доступность. Вот несколько ключевых особенностей:

- Адаптивный дизайн: интерфейс хорошо настроен под разные размеры экранов.

- Быстрая загрузка: минимизированные загрузочные времена позволяют наслаждаться игрой без задержек.

- Удобная навигация: интуитивно понятные меню облегчают поиск нужных игр.

- Доступ к бонусам: многие казино, включая Орка 88, предлагают специальные мобильные бонусы.

Специальные предложения и актуальные бонусы могут делать разницу, поэтому стоит обратить внимание на актуальные акции в вашем мобильном казино.

Доступные бонусы и предложения

Актуальные бонусы являются важной частью стратегии игры в онлайн-казино. Вот какие предложения можно ожидать:

| Тип бонуса | Описание | Применимость | |-------------------|---------------------------------|--------------------------------------| | Приветственный | 100% на первый депозит | Только для новых пользователей | | Бонус на второй | 50% на второй депозит | Специальное предложение | | Кэшбэк | 10% от проигрышей | Доступен всем игрокам | | Мобильные акции | Бонусы за игры из приложения | Для пользователей мобильной версии |

Доступность этих бонусов позволяет игрокам значительно увеличить свои шансы на выигрыш, подходя к каждой сессии с дополнительными средствами. Для более подробной информации о текущих акциях на Orka 88, посетите https://twobikers.ru.

Почему стоит выбрать Орка 88?

Если вы рассматриваете возможность играть в онлайн-казино, стоит выделить основные причины, по которым Орка 88 заслуживает вашего внимания:

- Разнообразие игр: множество категорий от слотов до настольных игр.

- Надежность: лицензированное казино с хорошей репутацией.

- Поддержка клиентов: круглосуточная поддержка через чат, электронную почту и телефон.

- Безопасность: высокие стандарты защиты данных и транзакций.

Каждый игрок найдет что-то свое в этом казино, которое сочетает в себе качество и безопасность.

Заключение

Мобильные технологии привнесли в мир азартных игр множество новых возможностей, и Орка 88 адаптировалась к этим изменениям, предлагая игрокам исключительный опыт. Быстрые загрузки, хорошая оптимизация и щедрые бонусы делают его одним из лучших выборов для любителей азартных игр. Не упустите шанс испытать удачу, играя в любое время и в любом месте! Более подробную информацию можно найти на сайте https://twobikers.ru.

Виртуальная игра в казино стала доступной для большинства людей благодаря онлайн-платформам. Одним из таких популярных мест является казино Олимп, где игроки могут найти широкий выбор азартных игр, включая слоты, покер и рулетку. Если вы задумываетесь о регистрации, то эта статья поможет вам разобраться в процессе и преимуществах, которые предлагает Олимп.

Простая регистрация в Олимп

Зарегистрироваться в казино Олимп может любой желающий, и этот процесс довольно прост. Необходимо всего лишь выполнить несколько шагов:

- Перейдите на официальный сайт Олимп: https://trek-power.ru.

- Нажмите на кнопку "Регистрация".

- Заполните предложенную форму, указав свои данные.

- Подтвердите свой аккаунт через электронную почту или СМС.

- Войдите в систему и ознакомьтесь с бонусами для новых игроков.

Таким образом, регистрация займет не более 10-15 минут, и вы сможете сразу же принять участие в игре.

Преимущества регистрации

Когда вы решаете зарегистрироваться в казино Олимп, вы получаете ряд преимуществ:

- Бонусы для новичков: Олимп предлагает щедрые приветственные бонусы для новых пользователей.

- Доступ ко всем играм: После регистрации вы получите полный доступ ко всем азартным играм платформы.

- Безопасность: Казино обеспечивает высокий уровень защиты ваших данных и финансовых операций.

Не забудьте проверить сайт на наличие акций, которые могут увеличить ваши шансы на выигрыш.

Вопросы и ответы

Какой минимальный депозит для начала игры в Олимп?

Минимальный депозит составляет 500 рублей.

Могу ли я играть без регистрации?

Да, вы можете попробовать демо-версии игр без создания учетной записи.

Какие способы оплаты доступны в Олимп?

Казино принимает многочисленные методы оплаты, включая банковские карты и электронные кошельки.

Есть ли мобильная версия казино?

Да, вы можете играть в Олимп на мобильных устройствах без потери функциональности.

Как связаться со службой поддержки?

Вы можете обратиться в службу поддержки через чат на сайте или по телефону.

Заключение

Проблем с регистрацией в Олимп не возникнет даже у новичков. Платформа предлагает качественный сервис и обширный выбор игр. Не упустите шанс воспользоваться приветственными бонусами, чтобы начать свою игру с максимальным комфортом. Для получения дополнительной информации о регистрации и бонусах посетите https://trek-power.ru.